hayward ca sales tax 2020

The California sales tax rate is currently 6. 2020 rates included for use while preparing your income.

This is the total of state county and city sales tax rates.

. In most areas of California local jurisdictions have added district taxes that increase the tax owed by a seller. Hayward Sales Tax Rates for 2022. Sales tax in Hayward California is currently 975.

The Hayward California sales tax is 975 consisting of 600 California state sales tax and 375 Hayward local sales taxesThe local sales tax consists of a 025 county sales tax a. The California state sales tax rate is currently 6. Hayward ca sales tax 2020 Saturday February 26 2022 Edit.

The 1075 sales tax rate in Hayward consists of 6 California state sales tax 025 Alameda County sales tax 05 Hayward tax and 4 Special tax. Ad Find Out Sales Tax Rates For Free. Those district tax rates range from 010 to.

This is the total of state and county sales tax rates. This includes the sales tax rates on the state county city and special levels. Rates include state county and city taxes.

The sales tax rate for Hayward was updated for the 2020 tax year this is the current sales tax rate we are using in the Hayward California. CA Sales Tax Rate. Hayward is located within Alameda.

The statewide tax rate is 725. California City County Sales Use Tax Rates effective April 1 2022 These rates may be. Those district tax rates range from 010 to.

4 beds 3 baths 2444 sq. 1788 rows California Department of Tax and Fee Administration Cities Counties and Tax Rates. The 975 sales tax rate in Hayward consists of 600 California state sales tax 025 Alameda County sales tax 050 Hayward tax and 300.

Hayward California Sales Tax Rate 2020. Revenue staff also administer bill and collect payments for various City tax programs including. Hayward california sales tax rate 2020 the 975 sales tax rate in hayward consists of 600 california state sales tax 025 alameda county sales.

The statewide tax rate is 725. The city council could impose a lower tax. The minimum combined 2022 sales tax rate for Alameda County California is 1025.

The average cumulative sales tax rate in Hayward California is 1075. The latest sales tax rates for cities starting with H in California CA state. Hayward in California has a tax rate of 975 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in Hayward totaling.

Fast Easy Tax Solutions. The minimum combined 2022 sales tax rate for Hayward California is 1075. Hayward California Sales Tax Rate 2020 The 975 sales tax rate in Hayward consists of 600 California state sales tax 025 Alameda County sales tax 050 Hayward.

Business Tax Excise Tax Transient Occupancy Tax and Utility Users Tax. You can print a 1075 sales tax table.

26279 Danforth Ln Hayward Ca 94545 Mls 40970100 Redfin

California Sales Tax Rates By City County 2022

26031 Hickory Ave Hayward Ca 94544 Mls 40985039 Redfin

29159 Colorado Rd Hayward Ca 94544 Mls 40977155 Redfin

3615 Sonia View Ct Hayward Ca 94542 1338 Mls 40927743 Redfin

23880 Clayton St Hayward Ca 94541 Mls 40913981 Redfin

29270 Sandburg Way Hayward Ca 94544 6456 Mls 40977137 Redfin

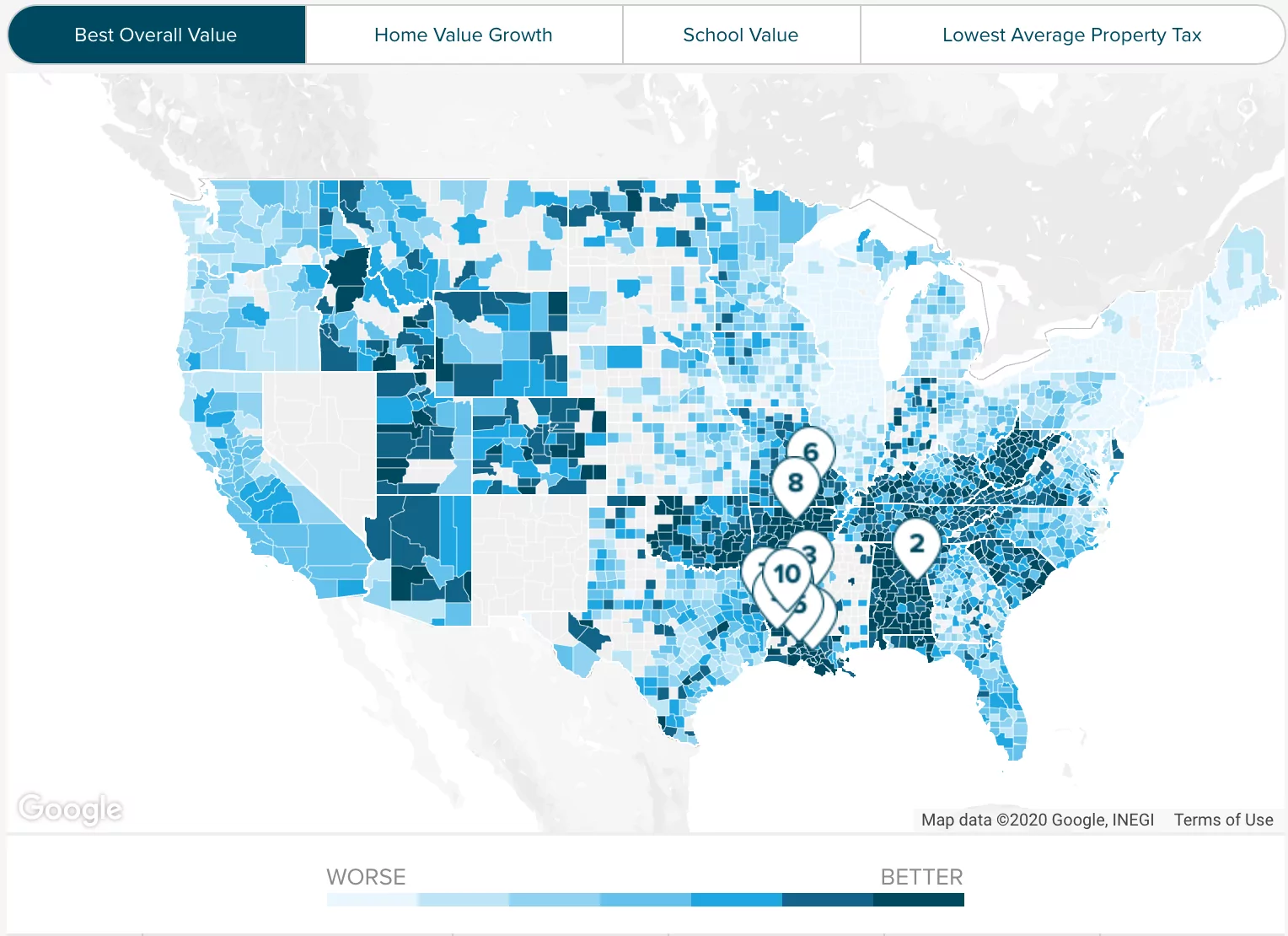

Alameda County Ca Property Tax Calculator Smartasset

List These California Cities Will See A Sales Tax Hike On July 1 Kron4

22959 Sutro St Hayward Ca 94541 Mls 40965236 Redfin

Used 2020 Dodge Challenger Rt For Sale Sold Silicon Valley Enthusiast Stock 101781

27621 Del Norte Ct Hayward Ca 94545 Mls 40955459 Redfin

Hayward California Ca Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

New Sales And Use Tax Rates In Fremont East Bay Effective April 1 Fremont Ca Patch

1285 Folsom Ave Hayward Ca 94544 Mls 40986769 Redfin

Dealers Must File Monthly Returns Pay Sales Tax Directly To Dmv Redline Dealer Education